Small business owners need to learn about how employer health insurance works in order to both attract and keep employees and manage their costs effectively. Small business owners incorrectly believe their size prevents them from offering significant benefits, but proper organization and assistance enable them to provide affordable group health coverage.

In this article, we review employer health insurance and how to help owners make knowledgeable decisions about coverage and answer the question: how does employer health insurance work?

Understanding How Does Employer Health Insurance Work for Small Businesses

The process of understanding how does employer health insurance work details for small businesses overwhelms business owners. Small businesses must provide employer health insurance to attract top talent and ensure a productive workforce. The constant increase in healthcare expenses presents a challenge for small businesses trying to maintain quality healthcare coverage. There might be superior healthcare solutions that businesses which haven't investigated them haven't discovered yet.

Business Insurance Health acknowledges that each business functions in its own distinct way. Our approach lets small businesses access top-quality enterprise solutions without facing the high costs usually associated with them. Understanding how does employer health insurance work allows small business owners to navigate the process and discover cost-effective and flexible options that meet their needs.

Small businesses can create competitive advantages through their understanding of how employer health insurance works. These plans improve business outcomes by protecting employees' health and building a supportive environment that generates a productive and loyal team. A complete benefits package enables organizations to attract skilled workers while maintaining high retention levels and establishing their reputation as caring employers.

Benefits of Employer Health Insurance for Small Businesses

By offering health insurance to employees, businesses achieve multiple benefits that exceed basic regulatory compliance. Providing health insurance to employees generates loyalty among staff members and attracts skilled job seekers while minimizing employee turnover. Employees place equal importance on health insurance from their employer as they do on their wages. Here are some additional reasons:

Competitive Advantage in Hiring

In tight labor markets, candidates compare benefits. Small business group health insurance plans help businesses stand out in recruitment. Your company shows respect for its employees through these benefits, which demonstrate your commitment to their health support. Providing company-sponsored health insurance builds trust with potential employees and enhances your reputation within the industry. Providing health benefits to employees leads to reduced turnover rates and establishes enduring organizational loyalty. Small business owners who grasp how does employer health insurance work have the ability to design benefits packages that transform their business into a desirable and stable place to work.

Small businesses may set themselves apart from bigger companies by offering health insurance benefits. In industries where skilled professionals are sought after, your benefits package might become the deciding element for top talent evaluating multiple job opportunities. Small businesses that offer employer health insurance distinguish themselves as compassionate and progressive employers, which helps them attract prospective employees.

Employee satisfaction remains strongly connected to their ability to access dependable healthcare services. Employees who understand their company values their welfare demonstrate higher work commitment because they feel appreciated and experience better engagement levels.

Healthier Employees Lead to Higher Productivity

When employees receive medical coverage, they tend to participate in regular health examinations and take preventive steps against illnesses while managing chronic health issues more effectively. Medical coverage access reduces sick days and work interruptions while also strengthening employee engagement levels. A strong employer coverage plan improves business performance by making staff retention and morale levels better, which results in business success. Your team obtains superior healthcare through PEO insurance or self-funded plans, which allows you to regulate spending on insurance while boosting staff productivity and business profits.

When employees have healthcare access, they tend to seek medical help earlier, which helps prevent the necessity of extensive, costly treatments later on. When employees maintain good health, they show higher levels of focus and energy, which boosts their engagement and improves their productivity at work. How does employer health insurance work? It helps reduce absenteeism by keeping employees healthier and more engaged.

The direct relationship between employee health and productivity is clear: Employees who maintain good health experience fewer sick days and extended absences and avoid burnout. The workplace atmosphere benefits while absenteeism decreases because employees maintain focus on their tasks and goal achievement.

Financial Incentives

The Affordable Care Act (ACA) offers substantial tax credits to small businesses that employ up to 25 full-time workers and pay at least half of their health insurance premiums. Group health plan expenses for small businesses become more manageable through major financial savings. Businesses that choose either self-funded insurance models or PEO insurance options gain further financial advantages because of their flexible plan features.

Businesses may qualify to apply for the Small Business Health Care Tax Credit (SBHCTC) when they offer health insurance plans that meet specific requirements. The tax credit enables businesses to cover significant portions of health insurance costs and makes it feasible for budget-conscious organizations to provide health benefits. Small businesses must seek professional advice to verify their eligibility for incentive programs, which offer significant health insurance cost savings for their employees.

Businesses that utilize flexible health insurance options such as PEO or self-funded plans achieve enhanced control over costs and mitigate risks. Businesses can tailor their premiums and benefits to match real requirements, which leads to reduced costs from unused benefits and unnecessary coverage.

How Does Employer Health Insurance Work?

Employer health insurance involves employers selecting and funding health coverage options for their eligible employees. Small businesses obtain group coverage options as they explore PEO services and level-funded plans for other health insurance solutions.

Small businesses need to understand how does employer health insurance work in order to balance providing quality benefits with maintaining cost efficiency. Employers need to thoroughly assess and compare health insurance plans because they differ significantly regarding coverage levels, price structures, and service offerings.

Employer Health Insurance in Group Health Insurance

Employers pay either partial or complete monthly premiums for their employees' health insurance coverage. Standard health insurance packages cover dental and vision treatments, while some may also offer life insurance provisions. Employees can include their dependents in their insurance coverage for an extra charge.

Businesses that choose a group health insurance plan receive coverage for all eligible employees through a single shared policy. Employees make their portion of health insurance premiums through payroll deductions, while their employer pays a part of it. Employers who pay insurance premiums can deduct these costs as business expenses, and this helps reduce the financial burden of providing insurance to employees.

Employers benefit from the adaptability of group health insurance plans, which enables them to tailor coverage options to meet their employees' specific needs. Employees receive a complete health coverage package, which includes dental benefits along with vision and wellness programs.

How Does Employer Health Insurance Work with Available Options?

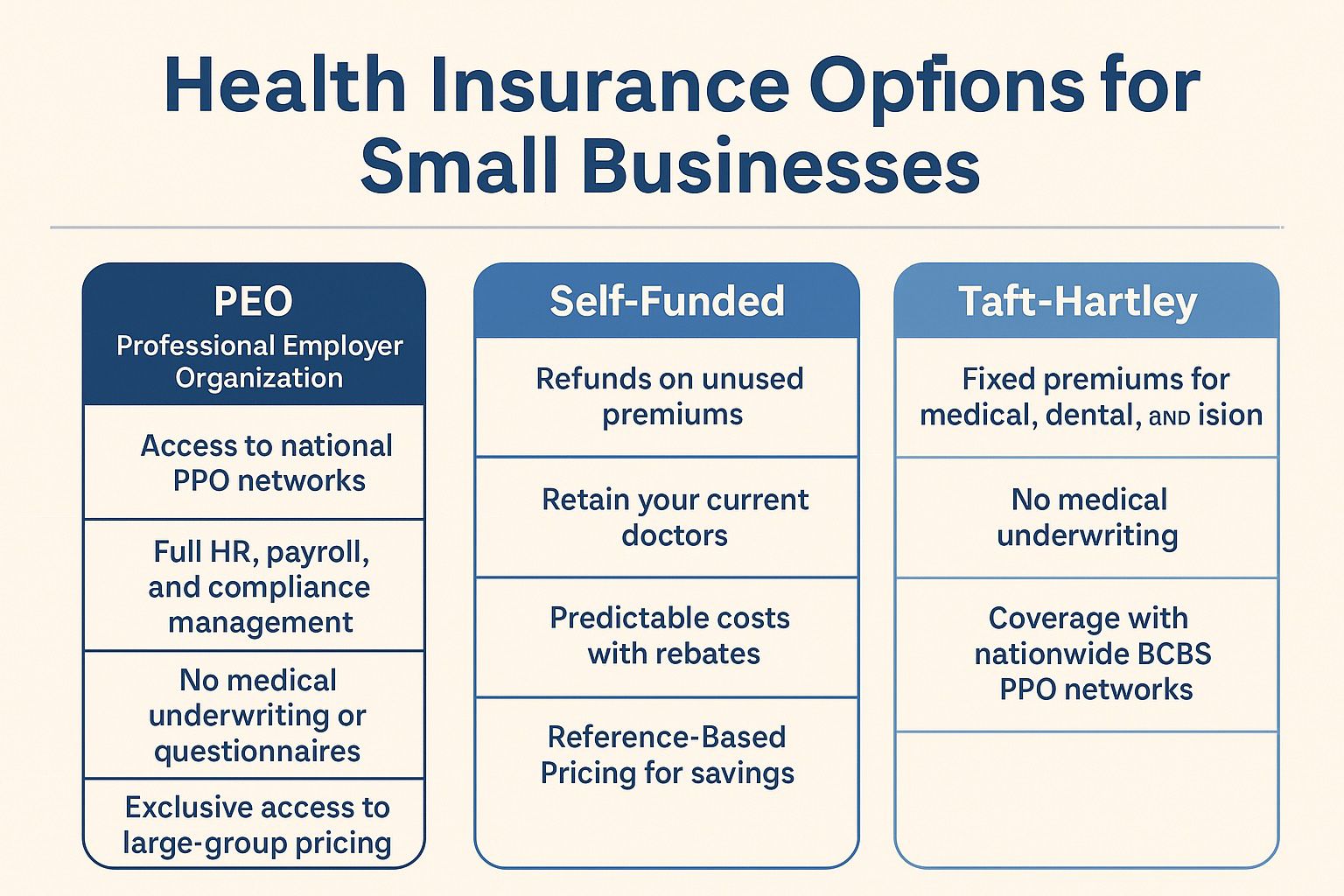

Business Insurance Health features three unique insurance models that meet small business needs.

PEO – Professional Employer Organization

Small businesses gain access to large group rates by entering into co-employment agreements with PEO health insurance providers. This includes:

- Access to national PPO networks

- Full HR, payroll, and compliance management

- No medical underwriting or questionnaires

- Exclusive access to large-group pricing

PEO services represent a beneficial alternative for small companies that want to provide health insurance programs similar to those available to bigger enterprises. Small businesses get access to large corporate benefits through PEO partnerships, which allows them to achieve economies of scale while avoiding high-cost expenditures.

Self-Funded / Level-Funded Plans

The business model merges direct payment of healthcare claims with stop-loss insurance to protect against unexpected high medical expenses. Benefits include:

- Refunds on unused premiums

- Your current healthcare providers will remain accessible through networks of BCBS as well as UHC, Aetna, and Cigna.

- Predictable costs with rebates

- Reference-Based Pricing for even more savings

Level-funded insurance plans provide businesses with the ability to pay for health claims when they arise instead of paying a predetermined premium amount upfront like traditional fully-insured plans. When the business uses less healthcare than expected, the company can achieve substantial savings. Businesses that predict their healthcare needs accurately can save money through premium rebates from unused funds.

Taft-Hartley Plans

Ideal for union-affiliated or multi-employer settings:

- Fixed premiums for medical, dental, and vision

- No medical underwriting

- Coverage with nationwide BCBS PPO networks

Taft-Hartley plans serve union workers and businesses that operate under multiple employer collective bargaining agreements. These plans maintain fixed premiums and equivalent benefits to standard employer-sponsored plans while serving exclusively union members and their relatives.

Cost Breakdown: What Small Businesses Should Expect

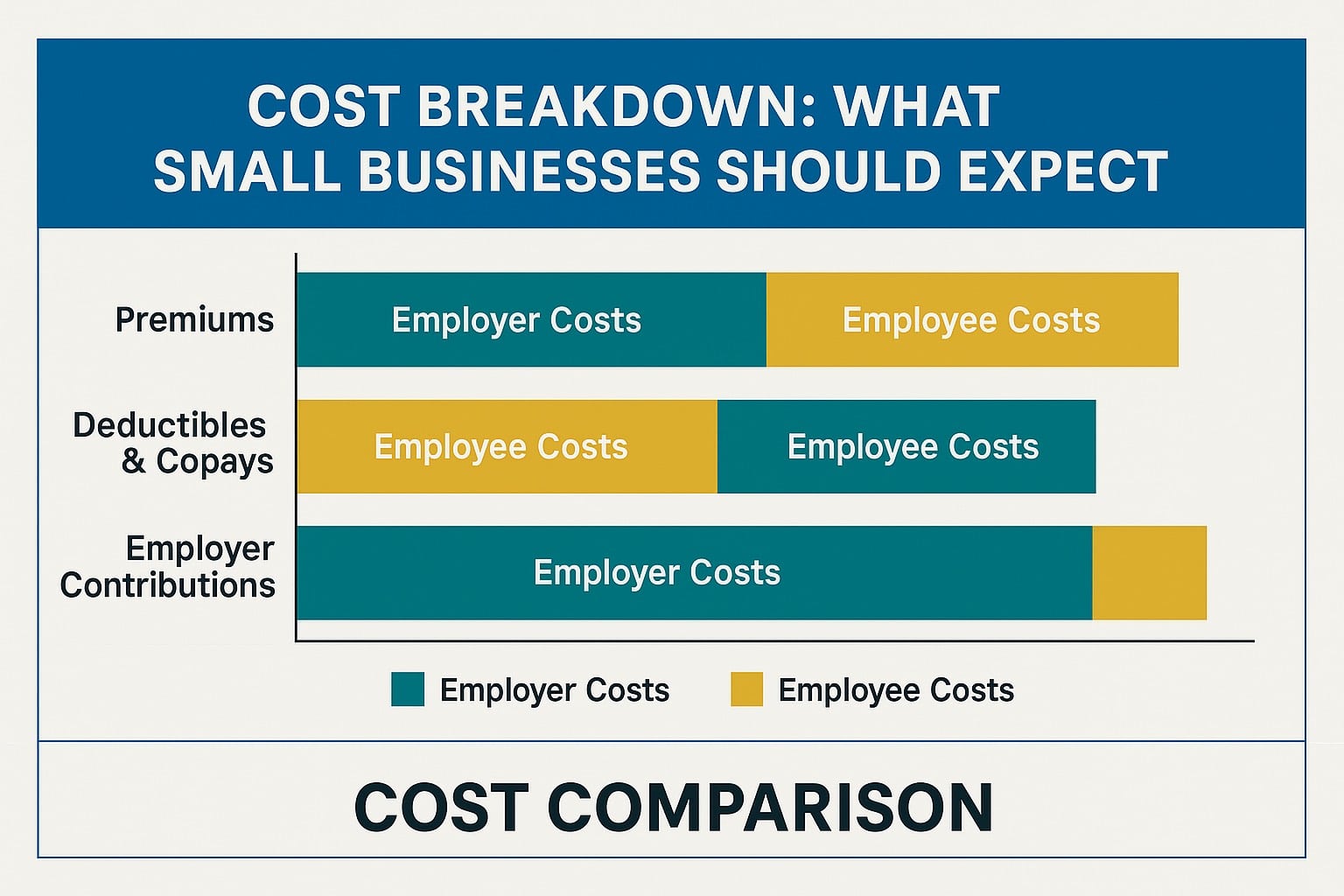

Health insurance expenses require understanding from owners of small businesses. Here's how it typically breaks down:

Premiums

The responsibility to pay health insurance premiums falls on both employers and their employees on a monthly basis. The selected group plan type and chosen coverage level determine premium costs, together with the provider network.

Small businesses often cover larger portions of their employees' insurance premiums as a way to reduce their financial stress. Because premiums remain consistent over time, businesses find it easier to set aside money to cover them. Small businesses that educate themselves on how does employer health insurance work and pick PEO health insurance benefit from lower premium rates together with enterprise-level benefits.

Deductibles & Copays

Medical services access requires employees to pay deductibles and copays, which constitute their out-of-pocket costs. These costs differ according to each plan. Copays consist of small fixed amounts paid at the time of medical services, whereas deductibles are substantial amounts that need to be paid before insurance coverage becomes active.

Through self-funded insurance choices, employers gain the ability to customize their deductible structures. Creating the right combination of deductibles and copays ensures employee health plans stay financially sustainable while maintaining ease of access for employees.

Employer Contributions

Businesses must contribute at least 50% towards monthly premiums, but many companies surpass this minimum according to their financial situation and strategic goals. Increasing their contribution levels allows employers to improve employee satisfaction and develop attractive benefits packages that appeal to potential recruits.

Employer contributions help retain employees while boosting the perceived value of working at the company. Small businesses secure large-group rates through how does employer health insurance work and PEO solutions that enable affordable higher contributions.

Conclusion

Understanding how does employer health insurance work is essential for small business owners who want to provide competitive and cost-effective benefits to their employees. By offering health insurance, businesses can attract top talent, improve employee health and productivity, and reduce turnover.

With various options like PEO, self-funded plans, and group health insurance, small businesses can find the right solutions to meet their needs. When done properly, employer health insurance can lead to long-term benefits for both the employer and the employees, creating a healthier, more loyal workforce.