Health insurance in the United States has long been a contentious issue, with millions relying on private insurers for essential medical treatments. However, increasing reports of delayed or denied treatments have led to mounting frustration among patients, doctors, and advocacy groups. This article examines the key reasons behind these concerns, the response from healthcare providers, and the direct impact on patient care.

- Rising Concerns with Health Insurance

- Millions of Americans depend on private insurers for medical coverage

- Growing dissatisfaction due to treatment delays and denials

- Impact on Patients and Healthcare Providers

- Financial hardship for patients due to high out-of-pocket costs

- Worsening health conditions and preventable deaths caused by denied treatments

- Administrative barriers making access to care more difficult

- Reasons for Increasing Frustration

- Insurers accused of prioritizing profit over patient care

- Complicated claims processes creating obstacles for timely treatment

- Rising costs and administrative hurdles adding to patient burden

- Response from Healthcare Providers

- Advocacy groups and medical professionals pushing for policy reforms

- Increased efforts to challenge insurance denials and delays

- Calls for greater transparency and accountability from insurers

- Overall Impact on Patient Care

- Delayed treatments leading to worsening health outcomes

- Increased stress and uncertainty for patients navigating the system

- Ongoing debates on the need for healthcare policy improvements

Main Reasons Behind Growing Frustration with Health Insurance Companies in the U.S.

One of the biggest sources of anger toward health insurance companies is their frequent denial or delay of essential medical treatments. Patients are often blindsided by unexpected bills or refusals to cover procedures they assumed were included in their plans. The causes of this issue range from insurers citing technicalities in policy language to outright financial motivations. Insurance claim denials have led to an increasing number of patients struggling to receive timely care. Below are the main factors fueling frustration across the country.

Denial of Coverage for Essential Medical Treatments

- Unexpected Financial Burdens: Patients frequently receive shockingly high medical bills when their insurance denies coverage for treatments. For instance, Callie Anderson, a Pennsylvania resident, was billed $14,658 for an intrauterine device (IUD) after her insurer deemed it ineligible under her “grandfathered” plan, leaving her financially unprepared.

- Disparities in Coverage: Many patients are unaware of exclusions in their policies until they are denied coverage, leading to financial distress and limited treatment options. Insurance claim denials often result in individuals being forced to seek alternative, less effective treatments.

Escalating Medication Costs Leading to Inaccessibility

- Life-Threatening Consequences: The rising cost of medications has made essential drugs unaffordable for many patients. A tragic example is 22-year-old Cole Schmidtknecht, who died from an asthma attack after being unable to afford his inhaler when the price jumped from $66 to $500.

- Sudden Policy Changes: Patients often experience unexpected policy alterations that remove coverage for critical medications, leaving them unable to afford necessary treatments. Insurance claim denials further exacerbate the situation by limiting access to essential prescriptions.

Administrative Hurdles Impeding Access to Care

- Prior Authorization Requirements: Insurers frequently require prior authorization for medical procedures, leading to delays in care. These processes can take days or even weeks, during which a patient's condition may deteriorate. Insurance claim denials often arise from unnecessary bureaucratic requirements.

- Complex Claims Processes: Many insured individuals struggle to navigate the complicated claims system, leading to significant delays in receiving the care they need. Patients may give up seeking treatment due to the stress of dealing with insurance bureaucracy. Insurance claim denials make it even harder for patients to access life-saving care.

Perception of Profit Over Patient Care

- Financial Motivations in Coverage Decisions: Many Americans believe that insurance companies prioritize their financial interests over patient health, leading to coverage denials based on cost-saving measures rather than medical necessity. Insurance claim denials have fueled distrust and resentment toward insurance providers.

- Distrust in the Insurance Industry: As more people experience delays and denials, public trust in health insurance providers continues to decline, exacerbating frustration and skepticism. Insurance claim denials contribute significantly to this loss of confidence.

Healthcare Provider's Responses to Increased Treatment Denials

Doctors and healthcare providers are increasingly pushing back against insurance companies’ growing influence over patient care. Physicians argue that excessive bureaucracy interferes with their ability to make timely medical decisions, leading to worse health outcomes. Some providers have taken an active role in challenging denials, advocating for their patients, and calling for reform in the insurance industry. Insurance claim denials remain one of the biggest challenges healthcare providers face today.

Advocacy for Patients

- Assisting in Appeals: Healthcare professionals are dedicating more time to helping patients file appeals when their insurance denies coverage. This extra effort is necessary but adds administrative burdens on already overworked doctors. Insurance claim denials often result in prolonged disputes that delay treatment further.

- Increased Awareness Campaigns: Medical organizations are speaking out against insurance policies that compromise patient health, pushing for legislative changes to protect consumers.

Calls for Systemic Reforms

- Streamlining Authorization Processes: Many healthcare professionals are calling for simplified prior authorization requirements to speed up treatment approvals and prevent delays that could lead to severe health consequences.

- Policy Changes to Protect Patients: Advocacy groups and medical associations are lobbying for new regulations that would ensure insurance companies are held accountable for unjust denials and delays. Insurance claim denials must be addressed at the policy level to prevent further harm to patients.

Impact of Insurance Claim Denials and Delays on Patients' Access to Necessary Medical Treatments

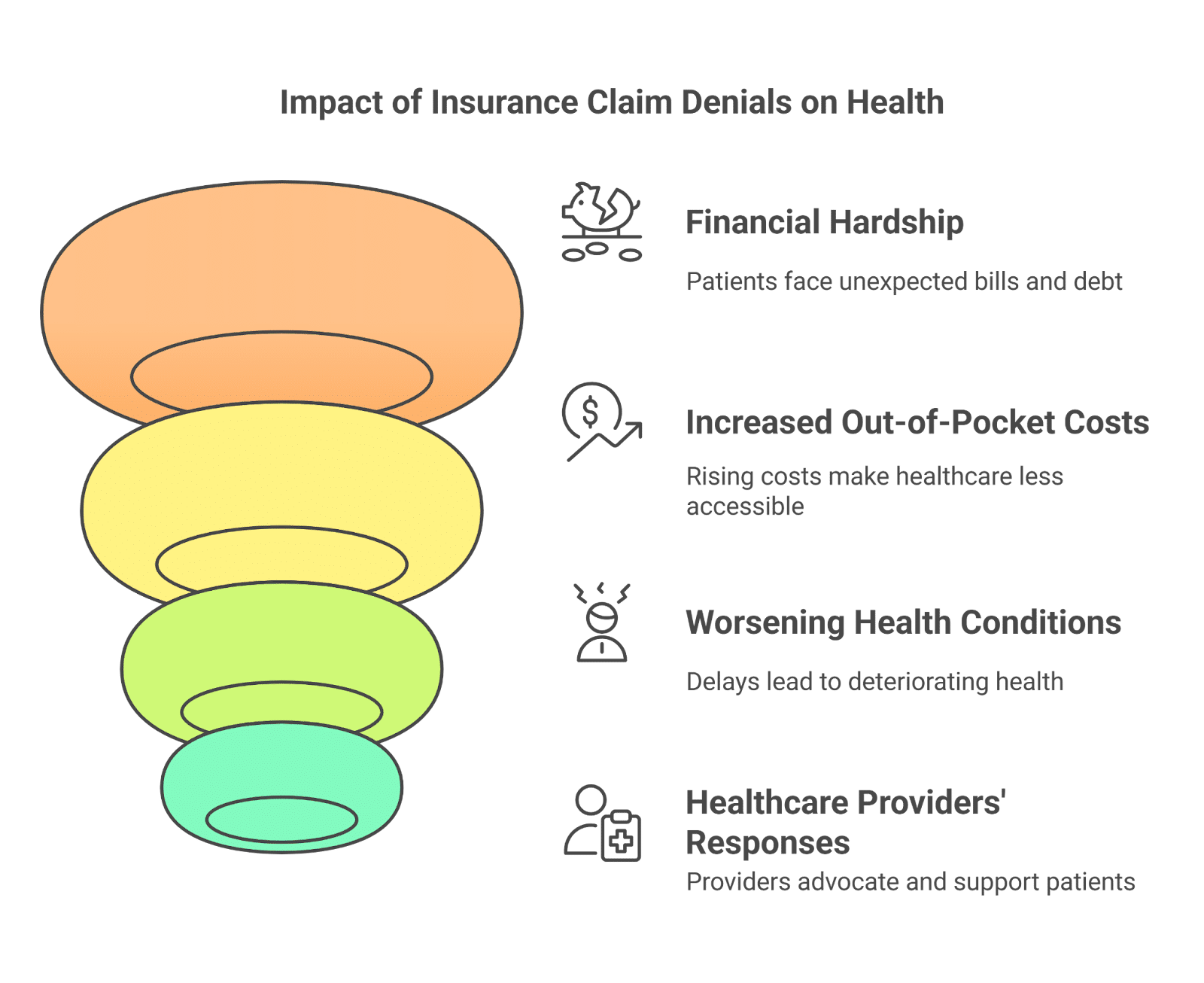

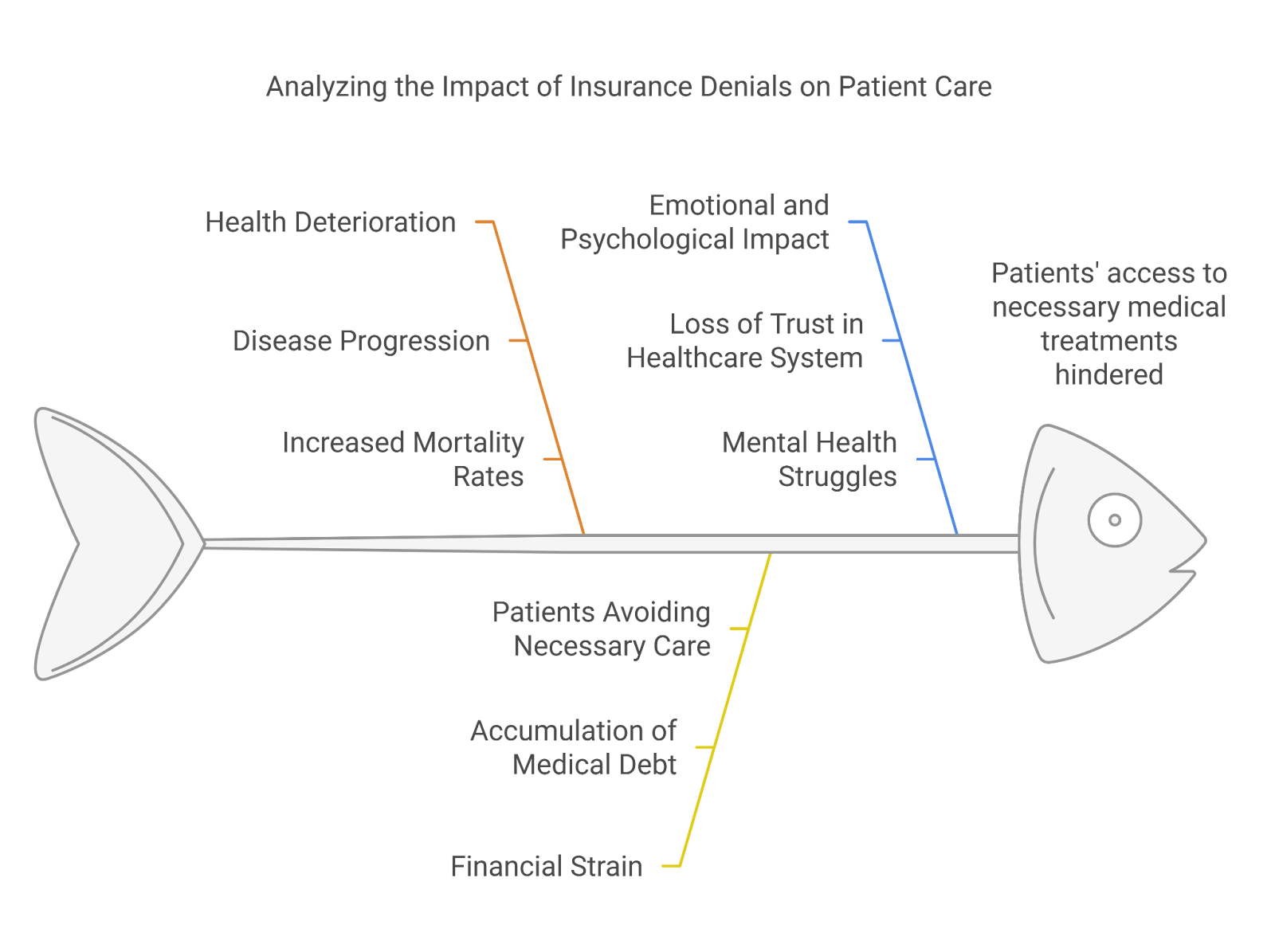

The consequences of insurance claim denials and delays extend beyond financial burdens—they also lead to significant health risks and emotional distress. Many patients find themselves unable to access life-saving treatments due to insurance complications, which can have devastating consequences.

Health Deterioration Due to Delayed Care

- Disease Progression: Delayed treatments caused by insurance claim denials can result in a worsening of medical conditions, reducing the effectiveness of later interventions and increasing the risk of long-term health complications.

- Increased Mortality Rates: In severe cases, treatment denials can lead to fatal outcomes, as seen in instances where patients could not obtain necessary medications or procedures in time.

Financial Strain Leading to Care Avoidance

- Accumulation of Medical Debt: Many patients end up in significant medical debt due to denied claims, often resulting in financial instability or even bankruptcy.

- Patients Avoiding Necessary Care: Some individuals choose to forgo treatment altogether due to fear of high medical costs, which can lead to deteriorating health and preventable medical crises. Insurance claim denials have a direct impact on whether people seek care.

Emotional and Psychological Impact

- Loss of Trust in the Healthcare System: Continuous struggles with insurance companies lead to feelings of helplessness, frustration, and a growing distrust in the U.S. healthcare system.

- Mental Health Struggles: The stress of navigating insurance claim denials and financial burdens can contribute to anxiety, depression, and other mental health challenges.

Overcoming Insurance Claim Denials: How Business Insurance Health Can Help You Get the Coverage You

The increasing frustration with health insurance companies in the U.S. highlights a system in need of urgent reform. Patients and healthcare providers alike are calling for changes that prioritize timely medical care over bureaucratic red tape and cost-cutting measures. Insurance claim denials not only create financial and emotional burdens but also pose serious risks to patient health and well-being.