California’s small businesses are feeling the pinch of skyrocketing health insurance costs. While offering health benefits is essential to attract talent, the expense often leaves owners asking, "Is it worth staying in business?" This article dives deep into the challenges of small business California health insurance, shares actionable tips to cut costs without compromising coverage, and explores how the recent election results, with Trump beginning his term, could reshape the healthcare landscape. Finally, we’ll highlight the critical role of intermediaries like PEO4YOU in finding the best plans for your team.

The High Costs of Small Business California Health Insurance

Health insurance costs for small business owners in California is among the highest in the nation. The state’s unique blend of high living costs, advanced medical care, and stringent regulations contribute to the financial burden. According to the Center for American Progress, traditional employer-provided health plans often fail to meet the affordability needs of small businesses, leaving them with limited options.

For small businesses operating on tight margins, the monthly premiums for comprehensive health coverage can be overwhelming. These expenses are particularly challenging for businesses with fewer than 50 employees, where offering health benefits can account for a significant portion of operational costs. The rising demand for supplemental health insurance for small business owners adds another layer of complexity.

The Economic Impact on Small Businesses

Without affordable small business California health insurance solutions, many small businesses struggle to attract and retain top talent. The inability to offer competitive benefits not only impacts workforce morale but also limits business growth. Employees often view health insurance as a critical factor when choosing where to work, making it essential for small business owners to prioritize coverage despite the costs.

Small Business California Health Insurance Amid Wildfire Risks

As wildfires continue to impact California, small businesses must navigate new challenges in protecting their employees’ health and financial well-being. From respiratory illnesses caused by poor air quality to mental health strains linked to evacuation and loss, access to comprehensive healthcare is more crucial than ever.

Why Wildfires Make Employee Health Coverage More Important

Wildfires pose a range of health risks, including respiratory problems from smoke exposure, stress-related conditions, and disruptions to regular medical care. Ensuring that employees have access to healthcare—whether through traditional insurance plans or alternative workforce solutions—can help businesses maintain productivity and workforce stability in crisis situations.

One effective approach for small businesses is to partner with workforce management providers that offer access to benefits, payroll, and HR compliance support. These services can help businesses maintain coverage and administrative stability, even when wildfires disrupt operations.

State Actions to Support Wildfire-Affected Businesses

Recognizing the financial strain that wildfires place on businesses, the California Department of Insurance has taken steps to provide relief. According to California Insurance Commissioner Ricardo Lara, insurers must now offer advance payments on claims, helping business owners cover urgent costs such as relocation, lost income, and employee support. This measure is intended to accelerate financial recovery for wildfire-impacted businesses, reducing the lag between disaster and economic stability.

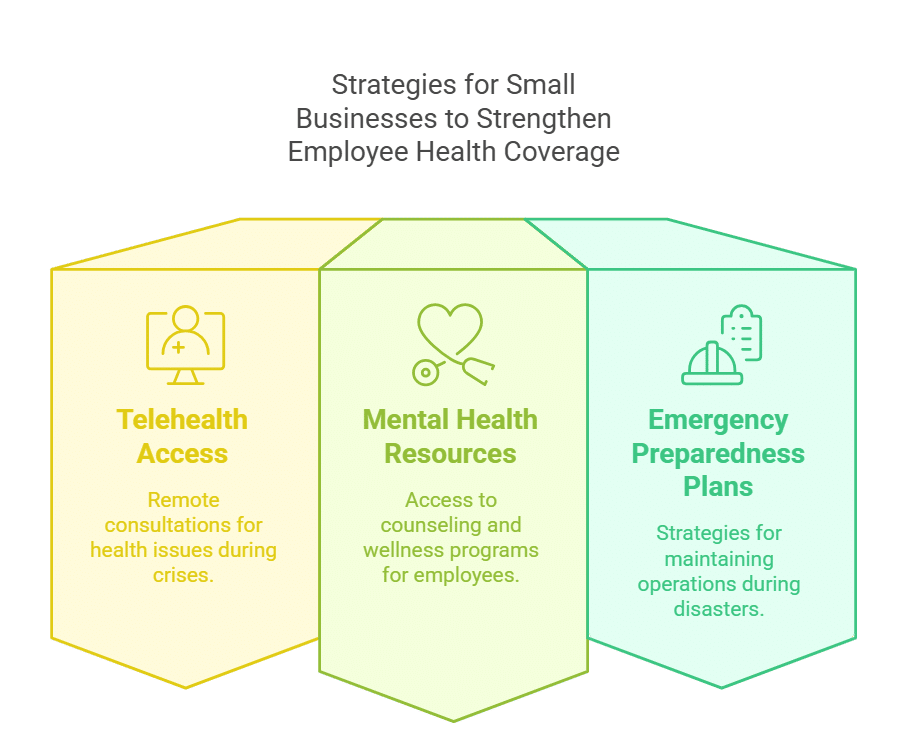

Key Strategies for Small Businesses to Strengthen Employee Health Coverage

With increasing wildfire risks, small businesses should consider:

- Telehealth Access – Remote medical consultations can be vital when air quality is poor or when employees are displaced.

- Mental Health Resources – Wildfires contribute to anxiety, PTSD, and burnout. Ensuring employees have access to counseling and wellness programs can improve long-term productivity.

- Emergency Preparedness Plans – Businesses should have clear policies in place for disaster-related disruptions, including strategies for maintaining health benefits and payroll continuity.

By staying informed about state initiatives and leveraging workforce management solutions, California small businesses can better protect their employees while navigating the challenges posed by wildfires.

The Influence of Elections on Health Insurance

The recent election, which saw Trump assume office, has already sent ripples through the healthcare sector. His administration’s policies are expected to reshape the Affordable Care Act (ACA), potentially phasing out subsidies critical to small business California health insurance affordability.

What Changes to Expect

- Potential Cuts to ACA Subsidies: These subsidies have helped millions afford coverage. If phased out, small businesses may face even higher premiums.

- Public Option Expansion: Trump’s campaign proposed new public options for healthcare, which could provide a cost-effective alternative to private plans.

Why Staying Informed Matters

Policy shifts can drastically alter health insurance costs for small business owners. Partnering with intermediaries like PEO4YOU ensures that you’re ahead of the curve, adapting your benefits strategy as needed.

For a broader perspective, Fast Company examines how changes to ACA subsidies could impact millions, including small businesses.

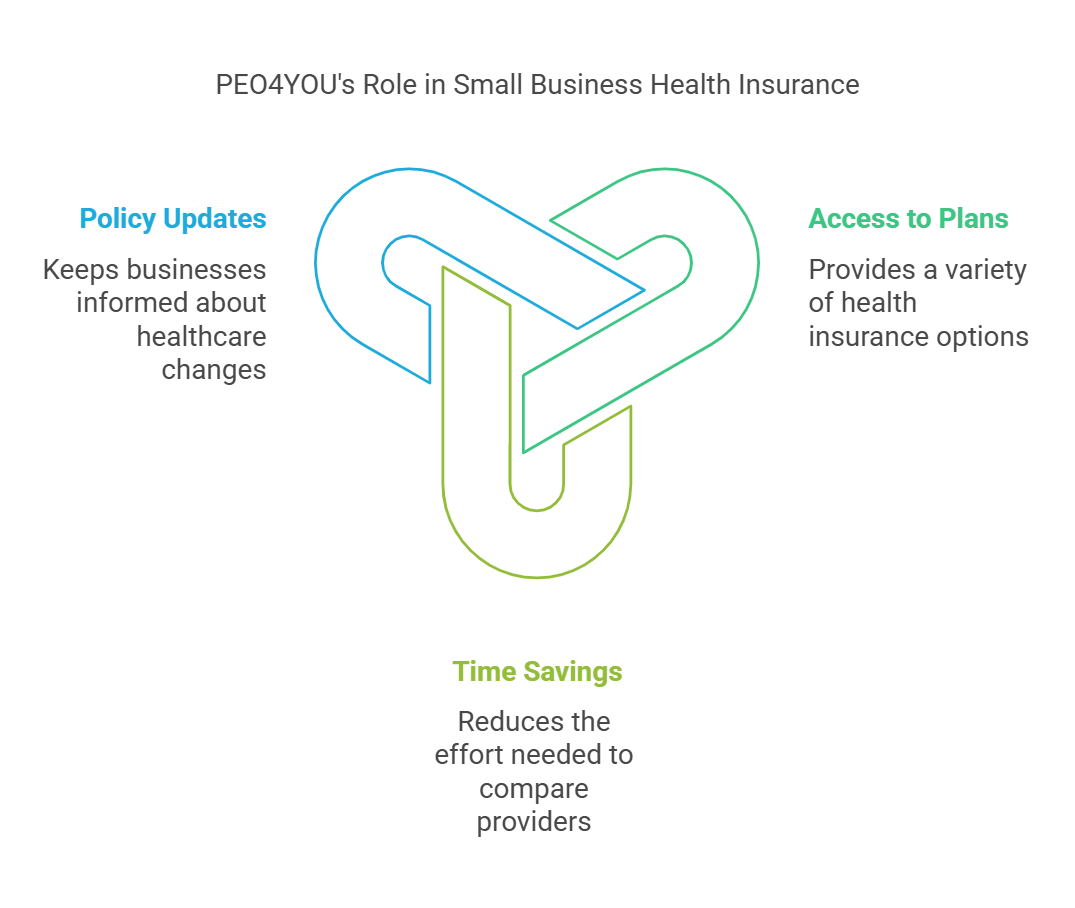

Leveraging PEO4YOU for Small Business California Health Insurance Solutions

Navigating the health insurance maze can be overwhelming, especially for small business owners with limited resources. This is where PEO4YOU comes in. As an intermediary, PEO4YOU connects businesses with tailored small business California health insurance solutions, ensuring affordability and comprehensive coverage.

By leveraging their expertise, small business owners can:

- Access a wider range of health insurance plans.

- Save time and effort in comparing providers.

- Stay informed about changes in healthcare policies and their implications.

Conclusion

The high costs of small business California health insurance pose significant challenges, but with strategic planning and the right resources, affordable solutions are within reach. By understanding your workforce needs, exploring public and private options, and partnering with experts like PEO4YOU, small businesses can secure health insurance that supports their growth and their employees’ well-being.

Under Trump’s administration, staying informed about policy changes is more crucial than ever. Offering health insurance isn’t just a financial decision; it’s an investment in the future of your business and your team. With the right approach, small business owners can navigate this complex landscape and emerge stronger.