In today's competitive market, securing an affordable small business health insurance plan is crucial for small business owners, independent contractors, and sole proprietors. Rising healthcare costs can strain limited budgets, making it essential to explore cost-effective solutions that benefit both employers and employees.

The Rising Cost of Health Insurance

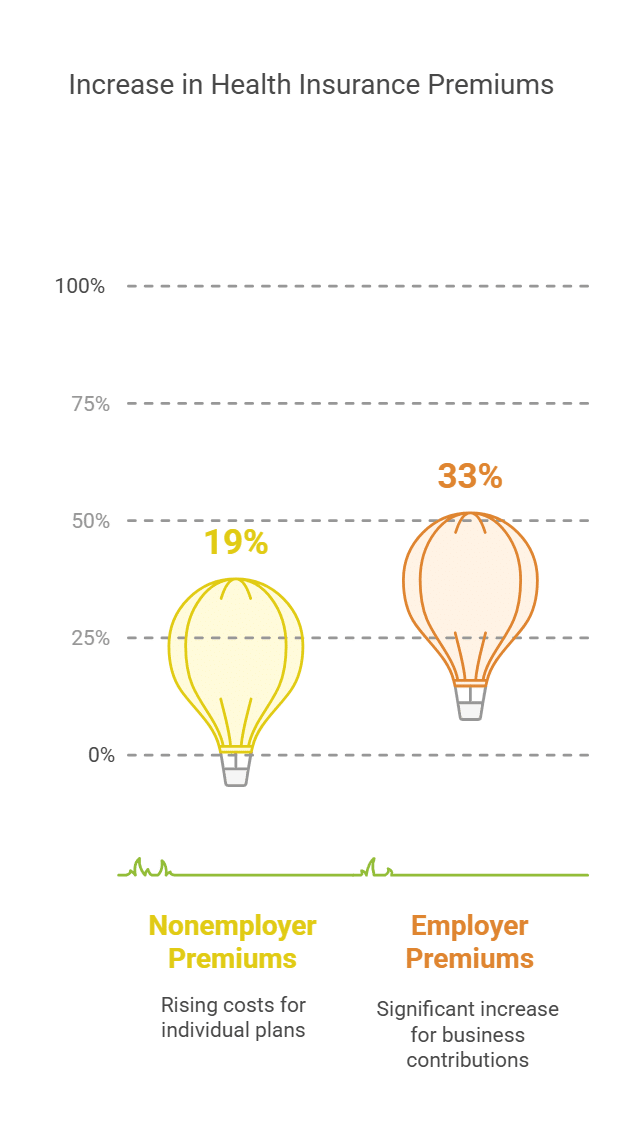

Health insurance premiums have been steadily increasing, posing significant challenges for small businesses. According to a report by the JPMorgan Chase Institute, over a five-year period, nonemployer health insurance premium payments rose by 19%, while employer premium contributions increased by 33%. These figures highlight the financial strain that health insurance can place on small businesses trying to provide benefits to their employees.

The cost of health insurance is one of the main reasons why many small businesses struggle to offer coverage. In fact, the report highlights that 65% of small business owners who do not provide health insurance cite cost as the primary reason. Without financial assistance or access to affordable options, many small businesses find it difficult to compete with larger companies that can offer more comprehensive benefits.

The Importance of Affordable Health Insurance for Small Businesses

Offering health insurance is not just a legal obligation in some cases; it also provides a strategic advantage. Providing health benefits can enhance employee satisfaction and loyalty, making it easier to attract and retain top talent. This is particularly important in competitive job markets where benefits packages can influence a candidate’s decision to accept a job offer.

Beyond employee retention, offering an affordable small business health insurance plan can lead to increased productivity. Businesses that provide health benefits see reduced absenteeism and a healthier workforce, as employees with access to healthcare can address medical issues promptly rather than waiting until their conditions worsen.

Moreover, the Affordable Care Act (ACA) continues to play a significant role in ensuring that entrepreneurs and small business owners have access to quality healthcare. In a recent article from Forbes, Rhett Buttle highlights how the ACA has expanded options for small business owners, allowing them to explore different plans and access financial assistance.

Strategies to Find an Affordable Small Business Health Insurance Plan

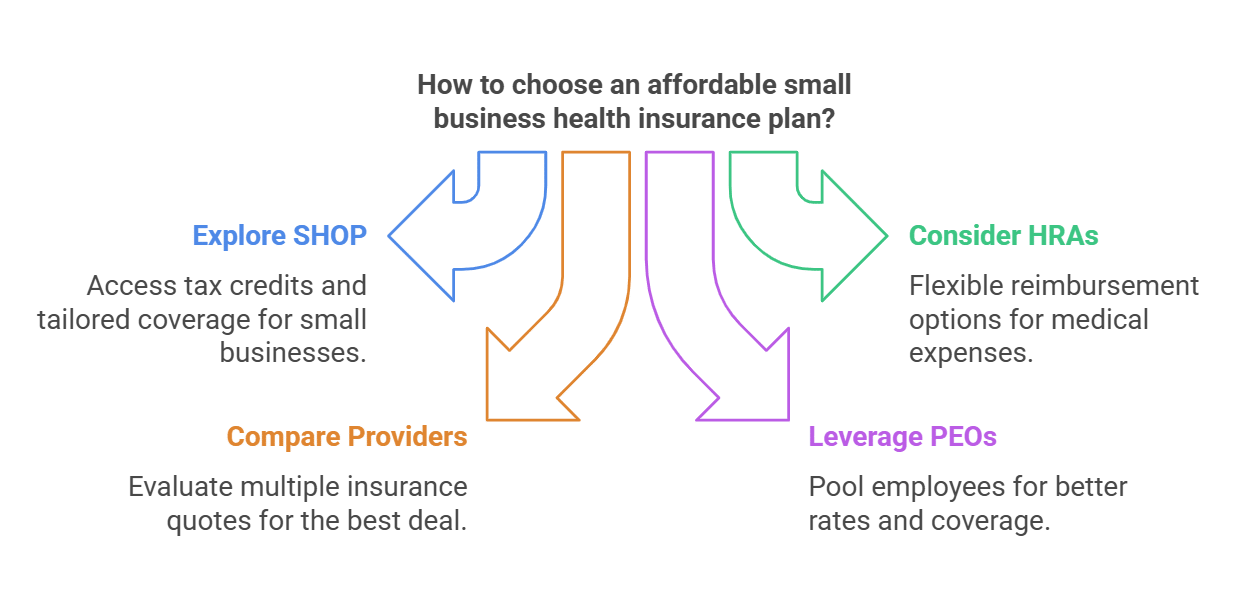

Finding an affordable small business health insurance plan requires careful consideration and strategic planning. Here are several approaches to help you secure the best coverage for your team:

1. Explore the Small Business Health Options Program (SHOP)

The SHOP Marketplace, established under the ACA, offers health and dental coverage tailored for small businesses with 1-50 full-time equivalent employees. According to HealthCare.gov, enrolling through SHOP can also provide access to the Small Business Health Care Tax Credit, which may cover up to 50% of employer premium contributions. To qualify, you must have fewer than 25 FTE employees with average annual wages below $56,000 and cover at least 50% of premium costs for your employees. This tax credit can significantly lower costs and make offering health benefits more feasible for small businesses.

2. Consider Health Reimbursement Arrangements (HRAs)

For businesses that cannot afford traditional group health insurance plans, HRAs offer a flexible alternative. HRAs allow employers to reimburse employees for medical expenses, including individual health insurance premiums, on a tax-free basis. This approach can be cost-effective while still providing essential healthcare coverage.

3. Compare Multiple Insurance Providers

When searching for an affordable small business health insurance plan, it's important not to settle for the first quote you receive. Business owners should compare health insurance, evaluating multiple plans side by side. By exploring different insurers and coverage options, you can find the most affordable and comprehensive plan for your team.

4. Leverage Professional Employer Organizations (PEOs)

Another way to access affordable small business health insurance plans is through Professional Employer Organizations (PEOs). PEOs pool employees from multiple small businesses to negotiate better rates with insurance providers. This strategy helps small businesses access the same quality coverage that larger companies can afford.

One company that specializes in helping small businesses find suitable health coverage is PEO4YOU. As an intermediary between clients and health insurance companies, PEO4YOU assists businesses in navigating the complexities of healthcare coverage, helping them secure the most affordable options available.

5. Educate Employees on Plan Utilization

Employers can also manage healthcare costs by ensuring employees fully understand their health benefits and take advantage of preventive care services. According to HealthCare.gov, preventive care services help detect health issues early, reducing long-term medical expenses and promoting a healthier workforce. Encouraging employees to use these services can lead to overall lower healthcare costs for the business.

6. Regularly Review and Adjust Your Plan

Healthcare needs and insurance offerings change over time, making it crucial for small business owners to regularly review their plans. Comparing your current plan with new options available in the market can help ensure you're providing the best coverage at the lowest cost. Keeping up with industry changes and new policy regulations can also help businesses remain compliant and take advantage of available financial incentives.

Conclusion

Securing an affordable small business health insurance plan is vital for maintaining a healthy, productive, and satisfied workforce. By exploring various strategies—such as utilizing the SHOP Marketplace, considering HRAs, comparing multiple providers, and partnering with organizations like PEO4YOU—small business owners can find cost-effective solutions tailored to their unique needs.

PEO4YOU acts as an intermediary between clients and health insurance companies, assisting businesses in navigating the complexities of healthcare coverage. Their expertise can help small business owners identify the most affordable and comprehensive health insurance plans, ensuring both employers and employees receive the best possible benefits.